“Can you recommend a book for…?”

“What are you reading right now?”

“What are your favorite books?”

I get asked those types of questions a lot and, as an avid reader and all-around bibliophile, I’m always happy to oblige.

I also like to encourage people to read as much as possible because knowledge benefits you much like compound interest. The more you learn, the more you know; the more you know, the more you can do; the more you can do, the more opportunities you have to succeed.

On the flip side, I also believe there’s little hope for people who aren’t perpetual learners. Life is overwhelmingly complex and chaotic, and it slowly suffocates and devours the lazy and ignorant.

So, if you’re a bookworm on the lookout for good reads, or if you’d like to get into the habit of reading, this book club for you.

The idea here is simple: Every month, I’ll share a book that I’ve particularly liked, why I liked it, and several of my key takeaways from it.

I’ll also keep things short and sweet so you can quickly decide whether the book is likely to be up your alley or not.

If you’ve already read a book that I recommend or have a recommendation of your own to share, don’t be shy! Drop a comment down below and let me–and the rest of us “book clubbers”–know!

Lastly, if you want to be notified when new recommendations go live, hop on my email list and you’ll get each new installment delivered directly to your inbox.

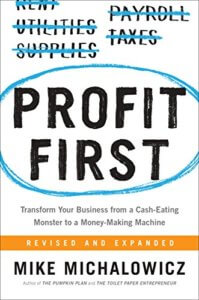

Okay, let’s get to the featured book: Profit First by Mike Michalowicz.

I chose this book because I often get questions regarding business, and often from people thinking of starting or who’ve just started a business.

This is one book I always recommend they read, because it highlights the vital importance of generating a healthy profit, not just revenue, as many people think.

Profit is imperative because if you focus too much on the top line (revenue) and too little on the bottom (profit), you can find yourself saddled with all the trouble, risk, and uncertainty involved in owning a business for less money than you could make working for someone else. What’s more, a lack of profitability is one of the primary reasons businesses fail.

So I’ve said many times that I wouldn’t want to own a business unless I could make at least three times more money than if I worked for someone else. It’s just not worth the hassle, and there’s a lot to be said for having a stable, high-paying job doing work you enjoy for a company you believe in and not having to worry about elements of the business that are rightly not your concern.

The bottom line is an unprofitable business (a business generating less than 5 percent in net income, which is what’s left for the owner after all expenses, interest, and taxes are taken out) direly needs an overhaul.

I’ve learned this lesson first hand in my businesses, which have ranged from super-profitable with my book publishing to super-unprofitable with my sports nutrition company, Legion.

It has taken a concerted effort to keep the publishing highly profitable and raise Legion’s net income to a normal level (around 10 percent of revenue). The first step was to embrace the message of this book and focus on growing the bottom line as aggressively as the top, and the second step was to put systems and controls in place to maintain the desired levels of profitability.

Let’s get to the takeaways.

Want to listen to more stuff like this? Check out my podcast!

My 5 Key Takeaways from Profit First by Mike Michalowicz

1

The new definition of success is not about the most revenue, employees, and office space but the most profit, generated through the fewest employees and with the least expensive office space. Make the game of winning based upon efficiency, frugality, and innovation, not on size, flair, and looks.

My Note

Revenue is a flashy metric. Millions in sales sounds impressive. But it doesn’t tell you how well a business is actually doing, and how likely it is to endure. Revenue is biceps and abs, and profit is hormone and cholesterol levels.

Consider this: my publishing company has generated $8 million in revenue since its inception, and my sports nutrition company Legion has generated a total of $63 million in sales. Which would you assume has made me the most money personally? Legion, right?

And you’d be wrong. I’ve received a lot more money from selling books than supplements, and that’s partly because the publishing company was generating far more profit until just a year or so ago.

This was partly by design—I was making enough money from books to not need much money from Legion, allowing me to reinvest large sums to continue growing the business—but not entirely. It was also largely because I was allowing Legion’s money to be spent too freely, mostly on inflated salaries of underperforming personnel and questionable marketing initiatives that didn’t pan out.

Now, my team and I run Legion’s finances more stringently, and by insisting on maintaining respectable profitability, it’s forced us to figure out how to get more from less, and the result is much higher returns on advertising and marketing spend and capital and equity.

This is just Parkinson’s Law applied to business, which states that something expands to match its supply. People often experience this as “lifestyle creep” in their personal lives, and in business, it’s “expense creep.”

And so you have to manage both your personal and business finances meticulously to ensure you can save and invest 10 (good) to 20 (great) percent of personal income and generate 10 (good) to 20 (great) percent of net income in your business.

2

The profit distribution is an award to the equity owners (you and anyone who invested in the business with money or sweat) for having the courage and risk tolerance to start the business. Don’t confuse the profit distribution with Owner’s Comp, which is pay for working in the business. Profit is a reward for owning the business.

My Note

If you own a business, you should get paid twice: once for the work you do in the business, like an employee, and it shouldn’t be lower than a market rate unless for tax purposes; and then again for the burden of owning a business and skill required to maintain it.

By default, profit shouldn’t remain in the business as “reinvestment,” “plowback,” or “profit retention” to fuel growth, or worse, to make ends meet. It should go to the owners, because a business should be able to remain solvent while also growing and producing a substantial net income, and if it can’t, it has major problems.

That said, business owners don’t have to take all net income out as distributions, especially if the business is generating more profit than the owners need to meet their personal financial obligations.

For instance, let’s say a business produces $500,000 dollars in profit per year, and the owner only requires $200,000 of it to cover their financial needs. What should they do with the remaining $300,000?

They should look at how they can put it to work, of course, and often, you’ll get the highest returns by investing your money back into your profitable business, which can use it to grow even faster. While putting the extra money into the stock market or real estate might return 5 to 10 percent over the following year, your business might return ten times that.

There’s a downside to reinvesting all excess profit, though: you’re placing all your eggs in one basket.

And so here’s what I do: I take 25 to 50 percent of net income out of my businesses and invest it into stocks, real estate, life insurance, and other vehicles, and I invest the remaining net income in projects that’ll further boost the growth of the businesses.

3

Absolutely do not ask people to take a pay cut. I did this with dire consequences. Asking all your people to continue to work just as hard or harder than ever for less money is worse for the emotional welfare of your company than letting just one more person go.

My Note

When times are tough and cash is tight, the owners must bear the brunt of the downturn, not the employees. To do otherwise is to shift risk and responsibility inappropriately, asking employees to act like owners. Remember—one reason owners should earn more when the business is flush is the willingness to earn less when it’s strapped.

If the owners have cut their pay (to zero, if necessary) and still more reduction is needed, you’re better off removing nonessential staff and asking your core team to temporarily work harder for the same pay than asking everyone to work just as hard for less.

Research shows that people are more averse to losing something they have than missing out on the opportunity to gain something they don’t, so they respond much worse to a cut in pay than an increase in hours, probably because losing money is more visceral and tangible than time.

4

When profit margins are big, usually in excess of 20 percent, people sniff out and almost immediately start to duplicate what you’re doing, and they look for ways to do it better, faster, and above all, cheaper than your company.

My Note

Play the game of business for long enough, and you’ll strike highly profitable veins from time to time. Sometimes it’s a new offering that does exceptionally well, sometimes it’s an advertising campaign that produces outsized returns, sometimes it’s a distribution win, and sometimes something else.

When this happens, you must do three things:

- Move quickly to exploit it fully before your competitors catch on and drive profitability down.

- Consider ways to consolidate your gains and forestall or diminish the effects of number one. Strategically, this can be viewed as building “moats” around your operations, making them less penetrable to outsiders.

- Keep prospecting for new similar opportunities, including those your competitors are currently harvesting, because number one will happen.

A good example of this in my work is early on, I realized that self-publishing bestselling books was not only remarkably profitable unto itself, but was also a highly profitable top-of-funnel activity for Legion.

I moved quickly by publishing more books—one every six months or so—consolidated my position by updating existing top-selling titles to improve them, writing articles and recording podcasts to lead people to my books, investing large sums into book advertising, and more; and I continued to build new avenues of customer acquisition for Legion as opposed to relying mostly on my book publishing.

5

To grow the biggest and the fastest, you need to be the best at one thing you do. And to become the best at something, you need to first determine what you are best at and do it a whole lot better.

My Note

This is a central tenet of the book Good to Great, which is a must-read if you want to own a highly rewarding business or even have a highly rewarding job.

In Good to Great, Collins explains that to be great, you must find what you can be the best in the world at, and then do as much of that and as little of everything else as you possibly can.

This is also a vital part of the “Hedgehog Concept,” which Collins coined to describe an essential strategic framework present in all the top-performing companies that he and his team analyzed.

In short, a Hedgehog Concept is something that a) you or your company can be the best in the world at, b) drives your economic engine, and c) you’re deeply passionate about.

Most of us aren’t trying to build the most successful companies in the world, however, so it’s reasonable to say that for us, a) could be downgraded to “extraordinary” or to borrow from Steve Martin, “so good they can’t ignore you.” That is, most of us don’t need to be the best in the world at anything to achieve our goals—just far better than most.

And, in the beginning of a business or career, the opportunity cost of most work is negligible (a bit of your time), so you simply say “yes” to basically everything, hoping to gain momentum. As things improve, however, opportunity costs rise and you have to get better and better at saying “no” to opportunities that would pull you away from your Hedgehog Concept.

Well, that’s it for this book club installment!